admin

admin

16 Nov 2022

16 Nov 2022

A US Expat’s Guide to FATCA

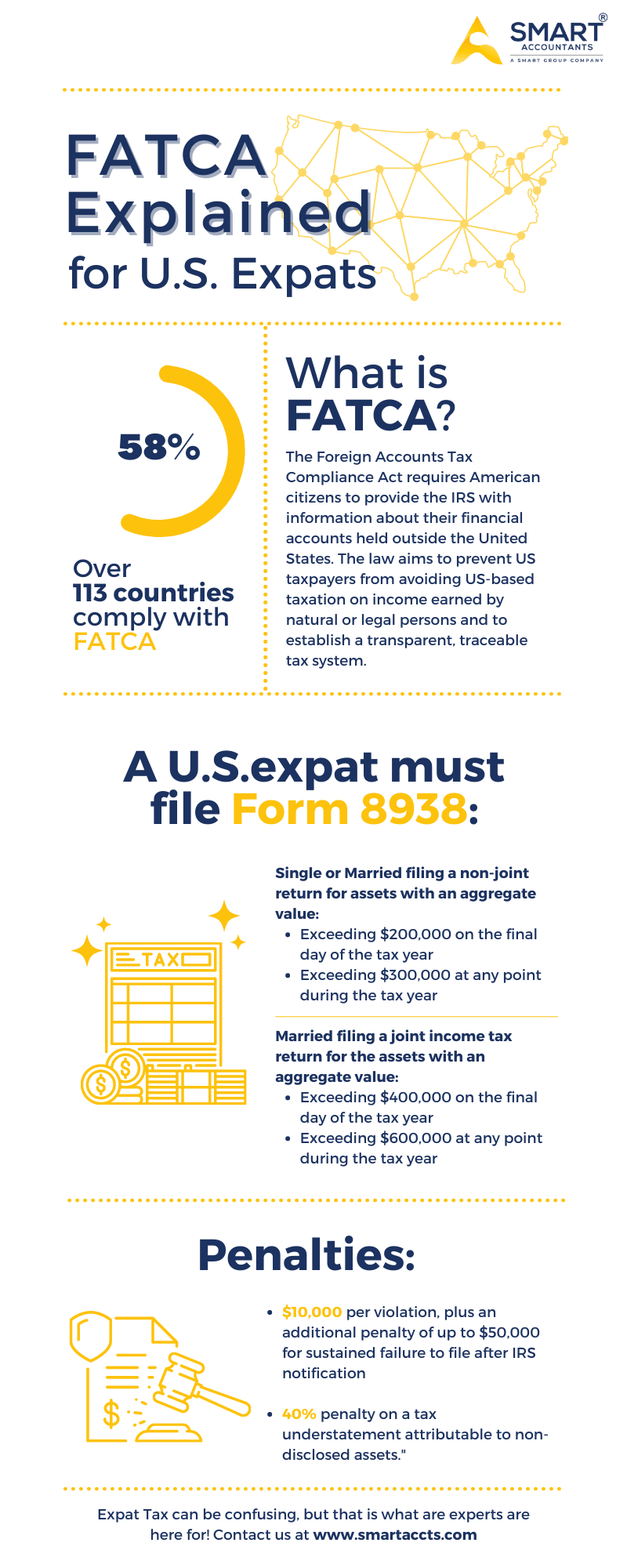

FATCA stands for Foreign Account Tax Compliance Act. As per this act, individuals having financial assets abroad are required to report those assets at the time of filing a federal tax return as per the FATCA filing requirement. Foreign financial institutions are required to report their US account holders.

How it is reported for EXPATS?

It is a straightforward process for expats and have no additional tax implications. This rule impels Americans with foreign registered assets to be declared on form 8938. It is applicable if the taxpayer as $200000 per person at the end of the year or $300,000 per person at any time during the year. The limits increases if the person is married and filed jointly.

Penalties:

Failing to report the assets on form 8938 incurs a penalty ranging from $10,000 to $50,000 per year.

Foreign Banks and FATCA:

All financial institutions like banks, funds, and investment and pension firms are required to sign up and comply with FATCA as per IRS. They need to report the US account holder details to IRS. Currently, there are 400,000 such institutions across the world.

Failing to comply they will be charged with a 30% withholding tax when they trade in US markets by the US government.

As a negative side of this rule, the foreign banks were facing an extra reporting burden. As a consequence of not increasing the burden of reporting they decided not to serve Americans and also closing their existing American EXPAT client’s bank accounts. They even don’t allow Americans to open new accounts, apply for loans or mortgages.

Due to this, thousands of Americans living abroad are unable to purchase their own house or does not have banking or credit facilities for their business. The majority of Americans living abroad are ordinary people. They don’t want to dodge taxes; however, at the same time, they are not even comfortable sharing their bank details like bank balance to the IRS.

5 Things to Keep In Mind while Filing FATCA:

1. FBAR and FATCA (Similarities and Differences)

Foreign Bank Account Report (FBAR) is comparable to the Foreign Account Tax Compliance Act (FATCA) in that it is likewise intended to detect tax evaders who use foreign bank accounts to hide money from Uncle Sam. FBAR reporting is distinct in that it applies to foreign account balances of $10,000 or more (even if the balance was kept for only one minute!). If applicable, you must electronically file FinCen 114 by October 15 each year. FBAR only applies to bank accounts; no other assets must be declared.

FATCA, on the other hand, is more exhaustive. Although you must record your international bank accounts and other foreign assets, the reporting criteria are significantly higher. FATCA filing is required if your assets exceed the following thresholds:

- Single Taxpayers Living Abroad $200,000 on the last day of the tax year or $300,000 at any point during the year

- Married Taxpayers Living Abroad $400,000 on the last day of the tax year and $600,000 at any point during the year

- Single Taxpayers Living in the US $50,000 on the last day of the tax year or $75,000 at any point during the year

- Married Taxpayers Living in the US $100,000 on the last day of the tax year or $150,000 at any point during the year

2. Identify What All Needs to be Reported

FATCA reporting requirements are more complicated than FBAR reporting requirements. Specified foreign assets make it difficult to determine whether assets precisely fall under this category.

- Foreign pensions

- Foreign stock holdings

- Foreign partnership interests

- Foreign financial accounts

- Foreign mutual funds

- Foreign-issued life insurance

- Foreign hedge funds

- Holdings in international real estate through a foreign entity (the real estate itself is not a reportable asset, but the foreign entity is, and the maximum value of the foreign entity includes the value of the real estate)

- Your overseas home is NOT required to be reported.

Confused? We understand. Our specialist CPAs are always available to assist you in determining which assets you may be required to report.

3. Renouncing Citizenship to Avoid FATCA May Be Unrealistic for Some

With more information about the ‘intrusive’ nature of FATCA, a growing number of Americans are considering relinquishing their citizenship. Giving up your US citizenship WILL exempt you from FATCA reporting requirements; however, this is not always the case.

First, the renunciation fee is $2,350. Correct, it will cost you $2,350 to surrender your passport. Some expats may find this cost prohibitive, and they will be “compelled” to continue submitting US taxes as citizens.

Second, there is a chance that you would be designated a “covered expat,” which could entail that you are subject to an exit tax. (Read this article for additional information about exit tax.)

Importantly, if you plan to expatriate, you must demonstrate five years of compliance with US expat taxes. Therefore, if you are not up-to-date on your US taxes, you must become compliant before filing for renunciation.

4. You May Encounter Banking Issues

Americans living abroad may encounter difficulties with foreign banks. FATCA reporting requirements for banks have become quite stringent, and many choose to avoid them entirely by refusing to do business with American clients.

The reporting requirements for US expats, regardless of whether they are established citizens or not, are simply not worth the effort for banks. US citizens may find that they are unable to open accounts or that their current bank has dropped them. Americans must be prepared for this possibility and maintain a bank account in the United States in case it occurs.

5. Penalties for Non-Compliance Are Harsh

According to the IRS, the penalties for failing to submit FATCA are “$10,000 per violation, plus an additional penalty of up to $50,000 for sustained failure to file after IRS notification, and a 40% penalty on a tax understatement attributable to non-disclosed assets.”

If you were ignorant of the reporting requirements, there are numerous ways to become compliant. Streamlined Filing Compliance Procedures, an IRS programme that allows innocent delinquent filers to catch up without incurring late filing penalties, is the most popular alternative for expats. There are no filing restrictions for this programme. You only need to self-certify that your failure to file was not intentional.

Expats who are reluctant to inform the IRS of their existence tend to engage in “quiet disclosures,” which entail filing back tax returns outside of an IRS amnesty programme and attempting to “fly under the radar.” This is an option, but it is a dangerous one. If the IRS discovers that you are attempting a silent disclosure and approaches you, you are no longer eligible to engage in amnesty programs, leaving you vulnerable to enormous penalties.

Tip: Generally, Smart Accountants advises US expats to file under the Streamlined Filing Compliance Procedures to minimise risks; there are no penalties and you can become compliant by filing 3 years of taxes and 6 years of FBARs.

FATCA Reporting Is Not Necessarily Complicated

We get it! Foreign financial reporting is oftentimes perplexing. The good news is, if you know you must file FATCA, you don’t have to do it alone. We can assist you in submitting Form 8938 to fulfill your FATCA reporting obligations and avoid penalties for noncompliance.

Still, Have Questions about FATCA filing requirements?

Contact us to obtain more information about what is FATCA and what is FATCA filing requirement.

Regardless of the countries in which American EXPATs reside, their tax liability in that country, or tax treaties, they are obligated to submit a federal tax return if their annual earnings exceed $12,000.

Contact our US EXPAT tax professional if you have any concerns or questions regarding US taxes from overseas.